The Financing My Dreams badge is part of the Financial Literacy badge set introduced in 2011.

Step 1: Explore dream jobs[]

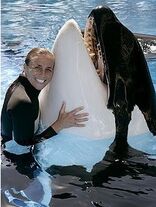

Dawn Brancheau with Nalani in 2009

Your first “job” is to make a list of your dream jobs. Think about all your hobbies, interests and talents – could any of them lead to a career? Use one of the choices below to help you make your list. Once you’ve got your list of dream jobs, pretend you’re 25 years old and doing some of those jobs. Research a rough estimate of the salary and your take-home pay. (Your take-home pay is your salary minus taxes and any benefits for which you pay.) Your budget starts with this money; fill it in on your worksheet.

CHOOSE ONE:

Track your dreams. For one week, keep your eyes open for jobs that interest you. You may spot them on TV, in the news, in a book or movie – or in your daydreams. Jot down each one in a notebook. Aim to have at least 25 cool jobs by the end of the week. Then, research for at least five of the jobs.

OR

Talk to people about their jobs. Interview at least three adults on the subject of jobs. What are their jobs like? What other jobs have they had? Is there anything they’d like to do instead? Once you’re done, use their ideas to pull together a list of at least a dozen of your own dream jobs. Research the average salaries for at least five.

OR

Hold a group brainstorm. Get together with your friends to come up with all kinds of jobs, from fantasy jobs (rock star, actress) to more conventional careers (salesperson, lawyer, teacher, doctor). Write down every job and have the group choose the top 15, then, divide up the list so that everyone takes several jobs to research. Find out starting salaries and report back to the group.

Dawn Brancheau (1969-2010) []

Dawn Brancheau was an American animal trainer at SeaWorld Orlando. She always dreamed of working with orcas and the dream became her reality.

On February 24, 2010, she was killed by SeaWorld's largest killer whale Tilikum. Since her death, the park does not allow trainers in the water with all killer whales.

Step 2: Price out buying your dream home[]

Imagine you’re heading home from your dream job. To what kind of home do you see yourself returning? Perhaps you’d love to live in a sky-high apartment or a cozy townhouse. Or, maybe you’d like a six-bedroom house in the country. Your challenge is to track down three real-life options similar to your dream home to find out how much each one costs. Once you’ve got a price, have an adult help ou figure out what a likely monthly payment would be using a simple online mortgage calculator. (See the box for more information.) Add this number to your worksheet, plus a rough estimate of utility and cable bills.

CHOOSE ONE:

Go house hunting. With an adult’s help, go online to search through homes for sale in your area – or for any place you dream of living.

OR

Get expert real estate advice. Set up an interview with a local realtor and tell them about your dream home. Then, search through available options together to pick your three winners. Since realtors are experts on the subject of home buying, they should, also, be able to help you figure out your monthly home costs.

OR

Browse real estate ads. You can often find free real estate magazines outside supermarkets or in the local paper. Grab at least three guides and use them to pick out your top dream homes. With an adult, go online to research monthly costs.

Your Monthly Mortgage Payment []

Most people do not pay the full price of a house when they buy it. They pay part of the cost – this is known as a down payment – and then the bank gives them a loan for the rest. This loan is called a mortgage. The buyers, then, pay a little bit towards their mortgage every month, until the loan is paid in full.

Many real estate websites have simple mortgage calculators. When you find a home you’d like to cost out, you’ll usually need to input these things:

“Purchase price” or “offer”:Use the listed cost of the home.

Down payment: Many realtors recommend a down payment that is 20% of the cost of the home.

Interest rate:“Interest” is the money you pay the bank for giving you a loan. This rate changes depending on the economy, but is usually between 4% and 6%.

Kind of loan, or “term of loan”: Common loans are for 15- or 30-year terms, which means it will take 15 or 30 years to pay off.

When you input these things, you should see a total monthly cost. You’ll want to make sure the cost, also, includes home insurance and/or property taxes. Insurance is something you buy to protect your home in case of burglary, flood, or other natural disasters, and property taxes are what you pay the government for owning a home. If these figures are not included in the calculation, you should be able to find them on the home listing.

Step 3: Research dream vacations[]

Now it’s time to figure out how much your dream vacations would cost. Make a list of all the places you dream of going. Do you want to travel on the Orient Express? Hike for three months through Nepal? Go skiing in Patagonia? Climb the Gran Tetons? Choose one of the following options to price at least three dream vacations. (Keep in mind you only need estimates of the costs, not exact figures.) Add information to your budget worksheet.

CHOOSE ONE:

Explore the world of travel opportunities. With an adult’s help, head online to price your trips using travel sites. Keep in mind that you can often find package trips that include everything from airfare and hotels to guides all wrapped up into a single price.

OR

Visit a travel agent. Ask the agent to help you price your dream trips. Find out what difference it makes to fly first class instead of coach, or to stay in a luxury hotel instead of a standard one.

OR

Create a tour group. Brainstorm all kinds of dream vacations with your friends. Once you’ve compiled your list, have each person pick three trips to research in more depth, and have everyone report back with the financial details.

Step 4: Make a dream giving goal[]

2015 GSNC Gold Awardee Rebecca Tredwell shows one of the four murals she created for lessons about Long Island’s habitats at the Tackapausha Museum.

With great power comes great responsibility. It’s time to think about how much you’d like to give to others in your dream life as a philanthropist – someone who donates time and money to help make the world a better place. Use one of the following steps to learn about philanthropists, then, set a target goal for how much money (or what percentage of your salary) you’d like to donate each year. Add it to your budget worksheet.

CHOOSE ONE:

Find local philanthropists. Do a bit of exploration to find out about philanthropists living in your community. These people don’t need to give away millions of dollars. They might donate a small amount every month to their favorite charity. Or, they might volunteer their time at a local animal shelter. The point is they’re making a difference. Speak with at least two philanthropists in your community to get a better idea of how you might like to give in the future.

OR

Learn what’s going on in the world of philanthropy. Magazines and websites regularly list the world’s top philanthropists. Have a family member or librarian help you find a couple of these lists and pick three of your favorite global do-gooders to study. What do they do that you’d like to do? Do they support charities that you’d support as well? And, what percentage of their worth do they donate?

OR

Research your favorite charity. Do you already have a cause that you plan to support one day? If so, research how a leading charity/nonprofit in that field uses money today. How much money do they collect each year? How is that money spent? And, if you donated money, for what exactly would you like to see your money used?

SAVE ENDANGERED ANIMALS []

- Steve Irwin was the host of the popular TV show The Crocodile Hunter. He was a conservationist who worked to promote awareness about endangered species and other environmental issues. Though he was killed by a stingray in 2006, his family continues his work. In the film, The Crocodile Hunter: Collision Course, Steve and his wife Terri attempt to save a crocodile from "poachers" not knowing that the two men are actually American Central Intelligence Agency (CIA) agents who are after them because the crocodile in the Irwins' possession has accidentally swallowed an important satellite tracking beacon.

FEED THE HUNGRY []

BUILD SCHOOLS AROUND THE WORLD []

BUILD HOUSES FOR THE HOMELESS []

PLANT MORE TREES []

Step 5: Add up your dreams![]

Total your dream life. First, figure out what other living expenses you might have and add them to your budget worksheet. For example, you have to buy food and you’ll probably need to pay for transportation (remember that if you have a car, you’ll need gas and insurance and you may have to make car payments and pay for the upkeep of your car). You may have student loan payments, too. Even toiletries add up – a s do clothes, pets, entertainment, and more. Now, take a look at your worksheet. What will you do to make your budget balance? On what good habits can you start now that will help you later?

CHOOSE ONE:

Plan with friends. Get together with your friends and compare your budget worksheets. Discuss the kind of trade-offs you might have to make in the future. Talk about what you’re willing to give up and what’s a must-have.

OR

Plan with your family. Show your budget to an adult family member and ask for tips about how to balance it. Are there certain trade-offs they would make? Do they have tips about how to save for your dreams?

OR

Plan over and over again. Experiment with what’s important to you. Choose a few dreams to take off your list, but only for now,; you may have money for them later. Recalculate your budget. Are you closer to having it balance? How did it feel to defer some items? You might want to play around with this, adding and subtracting various items and noticing which dreams feel the most important to you?

Dream Budget Worksheet

DREAM JOBS

My first dream job: ______________________________ Salary: _______________

The monthly take home pay: $ _____________________________________________

My second dream job: ______________________________Salary: _______________

The monthly take home pay: $ _____________________________________________

My third dream job: ______________________________ Salary: _______________

The monthly take home pay: $ _____________________________________________

DREAM HOME

My dream home: _______________________________________________________

The cost of my dream home: $ ____________________________________________

My monthly mortgage/property taxes: $ ____________________________________

My monthly utility bill: $ _________________________________________________

My monthly Internet/cable bill: $ __________________________________________

DREAM VACATION

My first dream vacation: ________________________________________________

The rough cost: $ _____________________________________________________

How much I have to save each month: $ _____________________________________

My second dream vacation: _______________________________________________

The rough cost: $ _____________________________________________________

How much I have to save each month: $ _____________________________________

My third dream vacation: ________________________________________________

The rough cost: $ _____________________________________________________

How much I have to save each month: $ _____________________________________

PHILANTHROPY

I want to give to: ______________________________________________________

My monthly donation: $ _____________________________________________

ADDITIONAL LIVING EXPENSES (per month)

Food $ ____________________ Car payment $ ____________________

Gas $ ____________________ Car insurance $ ____________________

Clothes $ ____________________ Student loan payment $ __________________

Toiletries $ ____________________ Entertainment $ ____________________

Pets $ ____________________